Recently, US President Donald Trump announced the imposition of tariffs on several countries to protect domestic industries and local products, including countries like China and India. The US has imposed a 27% ‘Discounted Reciprocal Tariff’ on India, affecting several sectors in India such as pharmaceuticals, automobiles, steel, and electronics. The impact of this can also be seen on India’s economy.

What Are Tariffs?

A tariff is a tax imposed by the government on imported or exported goods to protect their local industries. It is usually a percentage of the product cost that is collected by customs officials at entry points.

Types of Tariffs:

1. Import Tariffs —Tax on imports coming from overseas. (e.g., the U.S. imposing tariffs on Indian steel).

2. Export Tariffs — Export tax on goods from one’s own country (less common but used in some cases).

3. Protective Tariffs — Its main goal is to protect local industries by increasing the expense of foreign products.

4. Revenue Tariffs—Imposed primarily to generate government revenue.

Effects:

· Increase in domestic production

· Higher prices for consumers

· Trade tensions

· Economic impact

How Tariffs Work?

Imposing tariffs increases the market values of important products, leading to higher costs for these products, which causes the public to start using local products, which increases the demand for local industries' products and provides engagement, resulting in overall profits for the government.

Its main goal is to protect the domestic industry from foreign competitors.

By imposing tariffs, they prevent foreign manufacturers from selling their products at unfairly low prices (known as dumping), which leads to increases in the demand for local products.

How Does This Impact India?

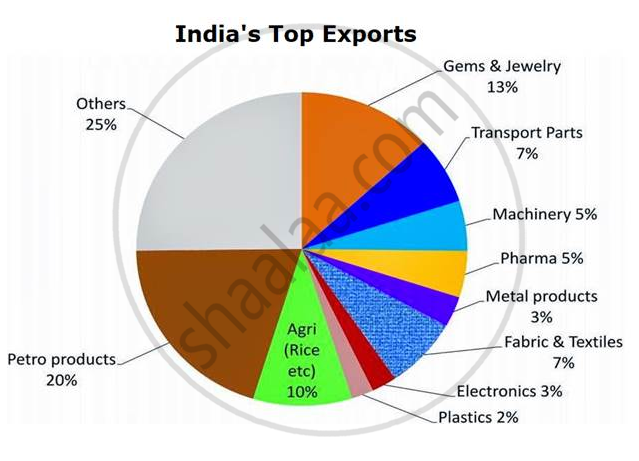

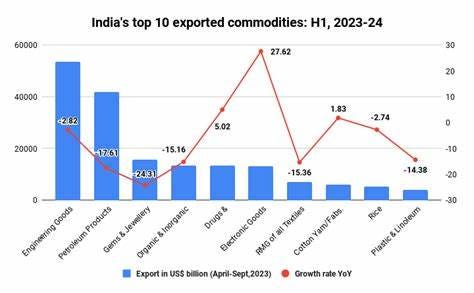

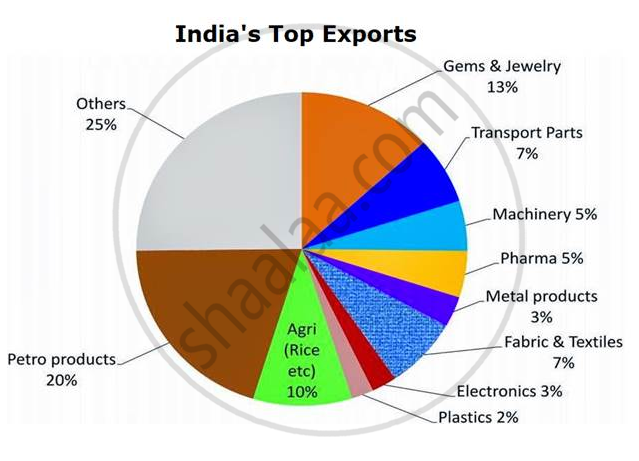

The US imposing a 27% discounted reciprocal tariff on India may lead to India facing several challenges economically and for Indian industries. India is considering slashing tariffs on $23 billion worth of US imports, including gems, jewelry, pharmaceuticals, and auto parts.

· Higher Costs for Indian Goods: Indian products become more expensive for American buyers.

· Reduced Competitiveness: Indian exporters struggle against cheaper alternatives from other countries.

· Job Losses in Export Sectors: Because of lower demand, industries may cut jobs.

2. Effect on Indian Imports from the U.S.:

· Higher Prices for Indian Consumers: American products become more expensive.

· Slower Industrial Growth: Indian industries that rely on US machinery and technology become costly.

Opportunities:

1. Boost to Domestic Manufacturing: If imports become expensive, India may develop its own industries for local products, which can generate growth and new employment for small industries.

2. Diversification of Trade Partners: India can also explore new markets for affordable products, which will reduce India’s reliance on the US.

3. Stronger “Make in India” Initiative: Government programs may push for self-reliance in key sectors.

Conclusion:

The U.S. tariffs on India present both challenges and opportunities for the Indian economy. While higher tariffs increase costs for Indian exporters and reduce competitiveness in the U.S. market, they also create a push for domestic manufacturing, trade diversification, and self-reliance initiatives like “Make in India.”

Adapting to these changes smartly will determine India’s position in the global trade landscape.

What Are Tariffs?

A tariff is a tax imposed by the government on imported or exported goods to protect their local industries. It is usually a percentage of the product cost that is collected by customs officials at entry points.

Types of Tariffs:

1. Import Tariffs —Tax on imports coming from overseas. (e.g., the U.S. imposing tariffs on Indian steel).

2. Export Tariffs — Export tax on goods from one’s own country (less common but used in some cases).

3. Protective Tariffs — Its main goal is to protect local industries by increasing the expense of foreign products.

4. Revenue Tariffs—Imposed primarily to generate government revenue.

Effects:

· Increase in domestic production

· Higher prices for consumers

· Trade tensions

· Economic impact

How Tariffs Work?

Imposing tariffs increases the market values of important products, leading to higher costs for these products, which causes the public to start using local products, which increases the demand for local industries' products and provides engagement, resulting in overall profits for the government.

Why Does the US Use Tariffs?For example, the US imposes a 6% tariff on imported white golf shoes, which makes them more expensive compared to local white golf shoes; hence, the public tends to use local products more due to their cheaper prices.

Its main goal is to protect the domestic industry from foreign competitors.

By imposing tariffs, they prevent foreign manufacturers from selling their products at unfairly low prices (known as dumping), which leads to increases in the demand for local products.

In the last few years, the US collected $80 billion from tariffs, which is very small compared to $2.5 trillion from income taxes and $1.7 trillion from Social Security and Medicare taxes.Historically, tariffs were also a major source of government revenue. Before the introduction of income tax in 1913, the US government’s economy relied on 90% of its revenue from tariffs. However, as global trade expanded after World War II, tariffs became less significant for revenue collection.

How Does This Impact India?

The US imposing a 27% discounted reciprocal tariff on India may lead to India facing several challenges economically and for Indian industries. India is considering slashing tariffs on $23 billion worth of US imports, including gems, jewelry, pharmaceuticals, and auto parts.

Here’s a look at the key sectors at risk:If the tariffs are sustained for six months, the impact on India’s economy is estimated at $8–10 billion in direct trade friction. This is not immaterial, but it constitutes only about 0.2% of India’s GDP.

- Impact on Indian Exports:

· Higher Costs for Indian Goods: Indian products become more expensive for American buyers.

· Reduced Competitiveness: Indian exporters struggle against cheaper alternatives from other countries.

· Job Losses in Export Sectors: Because of lower demand, industries may cut jobs.

2. Effect on Indian Imports from the U.S.:

· Higher Prices for Indian Consumers: American products become more expensive.

· Slower Industrial Growth: Indian industries that rely on US machinery and technology become costly.

Opportunities:

1. Boost to Domestic Manufacturing: If imports become expensive, India may develop its own industries for local products, which can generate growth and new employment for small industries.

2. Diversification of Trade Partners: India can also explore new markets for affordable products, which will reduce India’s reliance on the US.

3. Stronger “Make in India” Initiative: Government programs may push for self-reliance in key sectors.

Conclusion:

The U.S. tariffs on India present both challenges and opportunities for the Indian economy. While higher tariffs increase costs for Indian exporters and reduce competitiveness in the U.S. market, they also create a push for domestic manufacturing, trade diversification, and self-reliance initiatives like “Make in India.”

Adapting to these changes smartly will determine India’s position in the global trade landscape.