Sapna never had to worry about the costs of her education. Her parents took care of the tuition fees and cost of books. They even paid for any additional courses that she wished to attend. Sapna had completed her schooling and bachelor studies in Delhi. She now wanted to pursue higher education abroad. She had good grades and marks to back up her application. In fact, she even managed to gain admission to a prestigious international university. But finances were a matter of concern. Her father was a government employee. His savings were not enough to fund an education abroad. So, Sapna had to look for ways to finance her higher studies.

A personal loan for higher education is the best solution in these situations. The loan is easy to avail and provides the money you need. It is also easy to repay.

Here is a list of benefits you can get by opting for a personal loan for higher education:

Instant Approval

[/list]

The best feature of a personal loan is the ease of access. You have to apply for the loan and submit the documents required. Loan approval is quick. The funds become available within a few days of a successful loan application.

No Security Required

[/list]

Sapna’s father found this aspect of the loan most pertinent to his requirements. Personal loans do not demand any collateral, which suited him well. He did not have enough assets to pledge as security. Thus, the personal loan was an ideal option.

Minimal Documentation

[/list]

Applying for a personal loan requires minimal paperwork. You would simply have to submit proofs of identity, address, and income. Compare this to the listed of documents needed for a home loan. Indeed, getting a personal loan is much simpler.

Affordable Interest Rate

[/list]

The interest rate will not be high if you have a decent income and a good credit score. Sapna’s father’s income and credit score met the criteria. He availed the loan at an interest rate of 11.99% per annum.

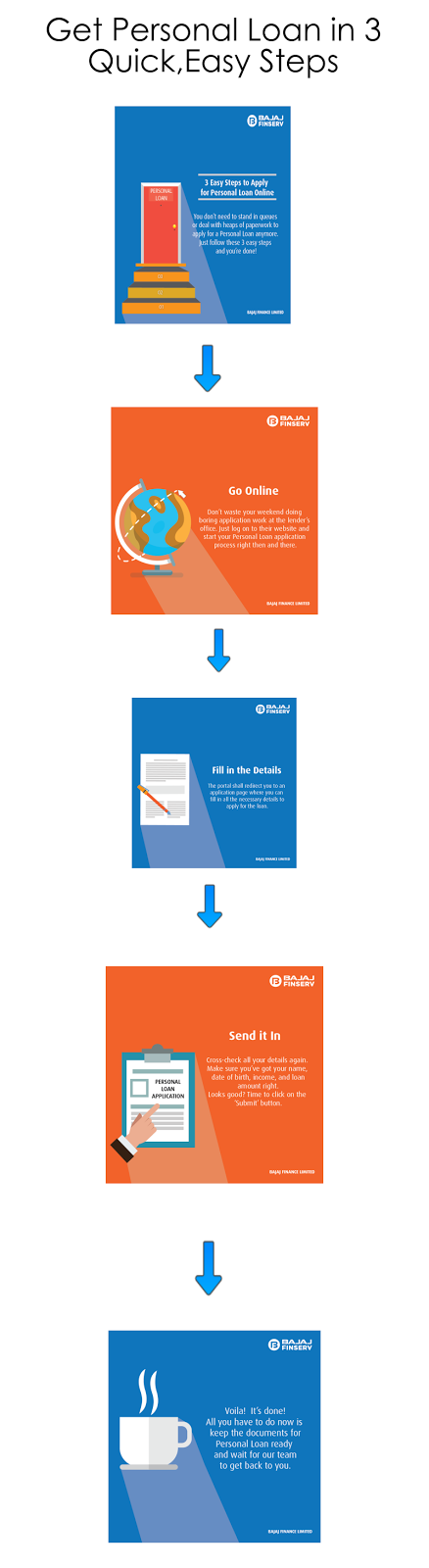

Process of Availing a Personal Loan

Here are the steps that Sapna’s father followed to get the loan

[*]

He checked his eligibility and the EMI amounts online.

[*]

Once satisfied with the EMIs, he applied for the loan online.

[/list]

[*]

He submitted the required documents. The lender then verified these documents.

[*]

Sapna’s father soon received approval for the loan. It came through within 24 hours of submitting the loan application.

[*]

He had the money in his account within the next three days.

[/list]

Sapna was then able to pursue her studies abroad and her father felt proud. He also informed his brother about the loan. His brother applied online and availed of a personal loan in Bangalore. He too wanted to send his daughter abroad to study. You too can use a personal loan to finance your child’s higher education abroad. Just do your research and select the best option.