Why Rising Interest Rates Hurt the Common Man: An Explainer

In the world of economics, the term "interest rate hike" often makes headlines. But behind those polished news articles lies a harsher truth — the common man pays the real price. While policymakers and economists may argue it's necessary to combat inflation, the ripple effect of rising interest rates is often devastating for ordinary families, small business owners, and young professionals.

Is it time to rethink how we approach inflation control? Let’s explore.

What Are Rising Interest Rates, and Why Do They Happen?

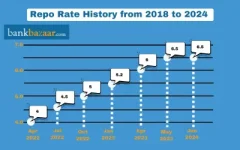

The Reserve Bank of India (RBI) adjusts the repo rate — the rate at which it lends to commercial banks — to manage inflation. When inflation rises, the RBI increases this rate, making borrowing more expensive. In theory, this cools down excessive spending and brings down prices.

But here’s the catch: this economic tool, often hailed as “stabilizing,” puts the financial burden squarely on the shoulders of the average citizen.

1. The EMI Trap: Crushing Middle-Class Dreams

Let’s face it — most Indians buy homes, cars, or even pay for education through loans. A rise in interest rates increases EMIs (Equated Monthly Installments) significantly.

For example, a 20-year home loan of ₹50 lakh at 7% interest demands an EMI of about ₹38,765. If interest rises to 9%, the EMI jumps to nearly ₹45,000 — a ₹6,000+ increase per month.

This isn’t just a number. It’s a cut in groceries, skipped vacations, delayed medical checkups, and dreams postponed.

2. "Affordable Credit" is Now a Myth for the Poor

We hear about financial inclusion all the time. But how does a higher repo rate serve that goal? The very people who need credit the most — small entrepreneurs, farmers, students — find it even harder to access affordable loans.

This isn’t just bad economics; it’s deeply unfair.

3. Less Borrowing, Fewer Jobs, Slower Growth

Here’s the real kicker: When borrowing costs rise, companies pull back on expansion. A delayed factory launch, postponed hiring plans, and cautious investments are all side effects of expensive credit.

In an already fragile job market, this means fewer opportunities and wider inequality.

4. Consumption Declines, Economy Slows Down

It’s basic logic: higher EMIs + expensive loans = lower spending. When people cut back on spending, industries like real estate, auto, tourism, and retail get hit. That’s the ironic twist — a policy designed to protect the economy ends up slowing it down from the inside.

5. What About the Silver Lining? Higher FD Rates?

Yes, rising interest rates benefit depositors — but only marginally. Fixed Deposit (FD) rates may rise, offering better returns for senior citizens, but this rarely offsets the widespread financial stress caused elsewhere.

Let’s be honest — this benefit is oversold in the media.

So, Who Really Benefits?

Here's a controversial take: Large financial institutions, hedge funds, and bondholders often benefit from interest rate hikes, while the salaried class, gig workers, and rural households pay the price.

That’s a discussion we don’t have enough.

The Bigger Question: Is There a Better Way?

Should inflation control always come at the cost of the average citizen? Could more targeted, sector-specific tools be used instead? For instance, reducing GST on essentials or tighter regulation of speculative commodities trading?

The conversation must shift from macro stability to micro resilience — ensuring that policy doesn't punish the very people it aims to protect.

Final Thoughts

Rising interest rates are more than just numbers in financial reports. They affect real people with real struggles. It's time we challenge the assumption that interest hikes are always the "right" move. Let’s start asking better questions — and demanding better answers.

In the world of economics, the term "interest rate hike" often makes headlines. But behind those polished news articles lies a harsher truth — the common man pays the real price. While policymakers and economists may argue it's necessary to combat inflation, the ripple effect of rising interest rates is often devastating for ordinary families, small business owners, and young professionals.

Is it time to rethink how we approach inflation control? Let’s explore.

What Are Rising Interest Rates, and Why Do They Happen?

The Reserve Bank of India (RBI) adjusts the repo rate — the rate at which it lends to commercial banks — to manage inflation. When inflation rises, the RBI increases this rate, making borrowing more expensive. In theory, this cools down excessive spending and brings down prices.

But here’s the catch: this economic tool, often hailed as “stabilizing,” puts the financial burden squarely on the shoulders of the average citizen.

1. The EMI Trap: Crushing Middle-Class Dreams

Let’s face it — most Indians buy homes, cars, or even pay for education through loans. A rise in interest rates increases EMIs (Equated Monthly Installments) significantly.

For example, a 20-year home loan of ₹50 lakh at 7% interest demands an EMI of about ₹38,765. If interest rises to 9%, the EMI jumps to nearly ₹45,000 — a ₹6,000+ increase per month.

This isn’t just a number. It’s a cut in groceries, skipped vacations, delayed medical checkups, and dreams postponed.

2. "Affordable Credit" is Now a Myth for the Poor

We hear about financial inclusion all the time. But how does a higher repo rate serve that goal? The very people who need credit the most — small entrepreneurs, farmers, students — find it even harder to access affordable loans.

This isn’t just bad economics; it’s deeply unfair.

3. Less Borrowing, Fewer Jobs, Slower Growth

Here’s the real kicker: When borrowing costs rise, companies pull back on expansion. A delayed factory launch, postponed hiring plans, and cautious investments are all side effects of expensive credit.

In an already fragile job market, this means fewer opportunities and wider inequality.

4. Consumption Declines, Economy Slows Down

It’s basic logic: higher EMIs + expensive loans = lower spending. When people cut back on spending, industries like real estate, auto, tourism, and retail get hit. That’s the ironic twist — a policy designed to protect the economy ends up slowing it down from the inside.

5. What About the Silver Lining? Higher FD Rates?

Yes, rising interest rates benefit depositors — but only marginally. Fixed Deposit (FD) rates may rise, offering better returns for senior citizens, but this rarely offsets the widespread financial stress caused elsewhere.

Let’s be honest — this benefit is oversold in the media.

So, Who Really Benefits?

Here's a controversial take: Large financial institutions, hedge funds, and bondholders often benefit from interest rate hikes, while the salaried class, gig workers, and rural households pay the price.

That’s a discussion we don’t have enough.

The Bigger Question: Is There a Better Way?

Should inflation control always come at the cost of the average citizen? Could more targeted, sector-specific tools be used instead? For instance, reducing GST on essentials or tighter regulation of speculative commodities trading?

The conversation must shift from macro stability to micro resilience — ensuring that policy doesn't punish the very people it aims to protect.

Final Thoughts

Rising interest rates are more than just numbers in financial reports. They affect real people with real struggles. It's time we challenge the assumption that interest hikes are always the "right" move. Let’s start asking better questions — and demanding better answers.