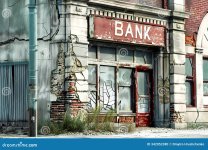

The world of banking and finance is undergoing a massive transformation—and not everyone is thrilled about it. While glossy advertisements still depict smiling bankers and “trusted institutions,” there’s a silent storm brewing beneath the surface: Fintech is eating traditional banking alive, and consumers are the ones holding the knife and fork.

1. From Marble Floors to Mobile Apps

Once upon a time, walking into a bank felt like entering a sacred institution. You dressed up. You waited in lines. You filled out forms. Today, with apps like Chime, Revolut, and Cash App, you can do more from your phone in five minutes than you could from a brick-and-mortar bank in a week.

Why wait three days for a wire transfer when a peer-to-peer app can move funds in seconds?

Traditional banks claim they're catching up—but are they really innovating, or just reacting?

2. Hidden Fees vs Transparent Fintech

One of the biggest controversies in banking is the continued reliance on junk fees—overdraft charges, ATM fees, monthly maintenance, etc. These fees disproportionately affect low-income customers, making banks billions every year.

Fintech platforms, on the other hand, pride themselves on transparency. No surprise charges. No minimum balances. Just straight-up services that make sense to a modern consumer. It begs the question: Have traditional banks been milking us all along?

3. Loans Without Bankers: A Dangerous Freedom?

AI-driven lending platforms now offer personal loans, mortgages, and even business funding—without ever talking to a human. This is liberating for some, especially those tired of being judged by a credit score. But here’s the catch: who’s regulating the algorithm?

Critics argue that fintech lending can sometimes amplify bias or push irresponsible credit. But others claim it’s the most democratized form of finance we’ve ever seen.

So—liberation or digital debt trap?

4. Crypto, DeFi, and the Unbanked

Another uncomfortable truth: billions of people are still unbanked globally. But crypto wallets and decentralized finance (DeFi) are changing that. With just a smartphone, someone in rural Africa or South America can store value, earn yield, or send money—all without ever touching a bank.

That’s revolutionary. And a bit scary—for banks, regulators, and even governments.

5. Are Banks Too Big to Adapt?

Legacy institutions are notoriously slow. Layers of bureaucracy and outdated infrastructure make innovation difficult. Fintech startups, on the other hand, are agile and built on modern tech stacks. Some argue that big banks are simply too bloated to survive the new age of finance. Others say they’ll just acquire the competition and stay relevant.

Time will tell—but the balance of power is shifting.

---

Final Thought:

Banking is no longer just about saving money—it’s about control. And for the first time in history, the people might actually have more of it than the institutions.

The fall of traditional banking systems

AI- driven lending and digital finance future

1. From Marble Floors to Mobile Apps

Once upon a time, walking into a bank felt like entering a sacred institution. You dressed up. You waited in lines. You filled out forms. Today, with apps like Chime, Revolut, and Cash App, you can do more from your phone in five minutes than you could from a brick-and-mortar bank in a week.

Why wait three days for a wire transfer when a peer-to-peer app can move funds in seconds?

Traditional banks claim they're catching up—but are they really innovating, or just reacting?

2. Hidden Fees vs Transparent Fintech

One of the biggest controversies in banking is the continued reliance on junk fees—overdraft charges, ATM fees, monthly maintenance, etc. These fees disproportionately affect low-income customers, making banks billions every year.

Fintech platforms, on the other hand, pride themselves on transparency. No surprise charges. No minimum balances. Just straight-up services that make sense to a modern consumer. It begs the question: Have traditional banks been milking us all along?

3. Loans Without Bankers: A Dangerous Freedom?

AI-driven lending platforms now offer personal loans, mortgages, and even business funding—without ever talking to a human. This is liberating for some, especially those tired of being judged by a credit score. But here’s the catch: who’s regulating the algorithm?

Critics argue that fintech lending can sometimes amplify bias or push irresponsible credit. But others claim it’s the most democratized form of finance we’ve ever seen.

So—liberation or digital debt trap?

4. Crypto, DeFi, and the Unbanked

Another uncomfortable truth: billions of people are still unbanked globally. But crypto wallets and decentralized finance (DeFi) are changing that. With just a smartphone, someone in rural Africa or South America can store value, earn yield, or send money—all without ever touching a bank.

That’s revolutionary. And a bit scary—for banks, regulators, and even governments.

5. Are Banks Too Big to Adapt?

Legacy institutions are notoriously slow. Layers of bureaucracy and outdated infrastructure make innovation difficult. Fintech startups, on the other hand, are agile and built on modern tech stacks. Some argue that big banks are simply too bloated to survive the new age of finance. Others say they’ll just acquire the competition and stay relevant.

Time will tell—but the balance of power is shifting.

---

Final Thought:

Banking is no longer just about saving money—it’s about control. And for the first time in history, the people might actually have more of it than the institutions.

The fall of traditional banking systems

AI- driven lending and digital finance future